fsa health care contribution

The Dependent Care FSA. This is an increase of 100 from the 2021 contribution limits.

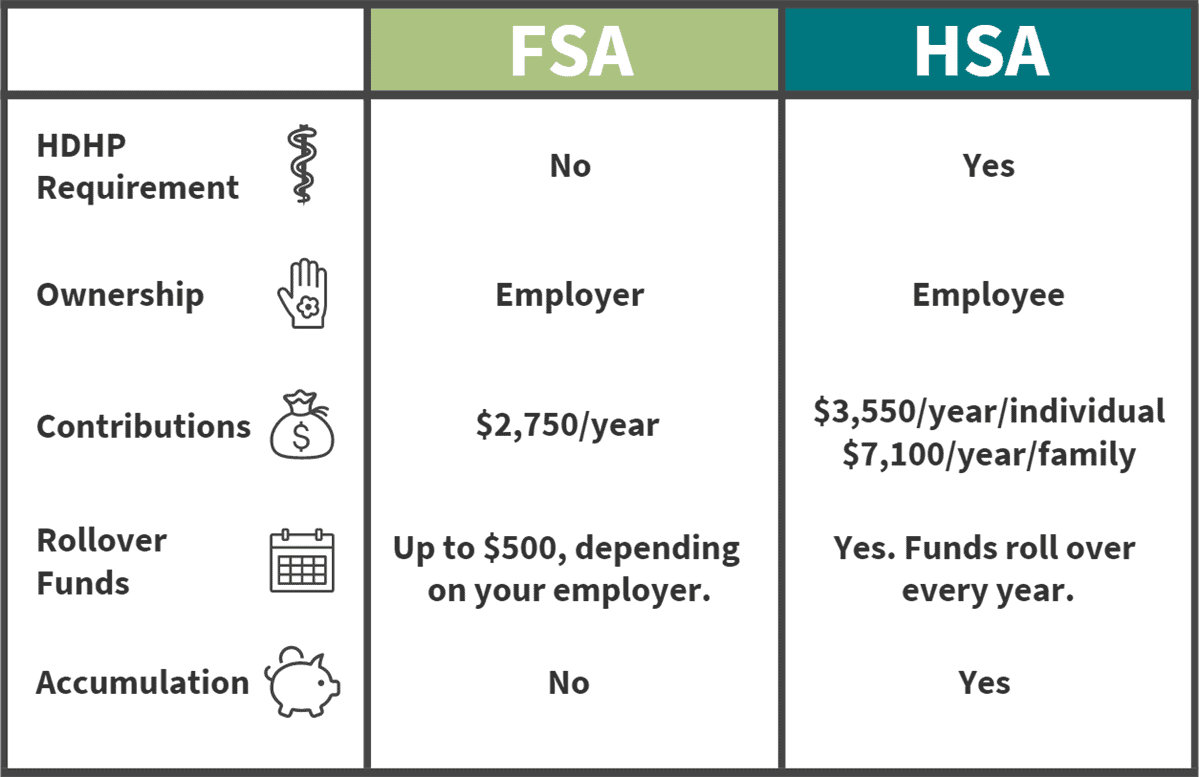

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

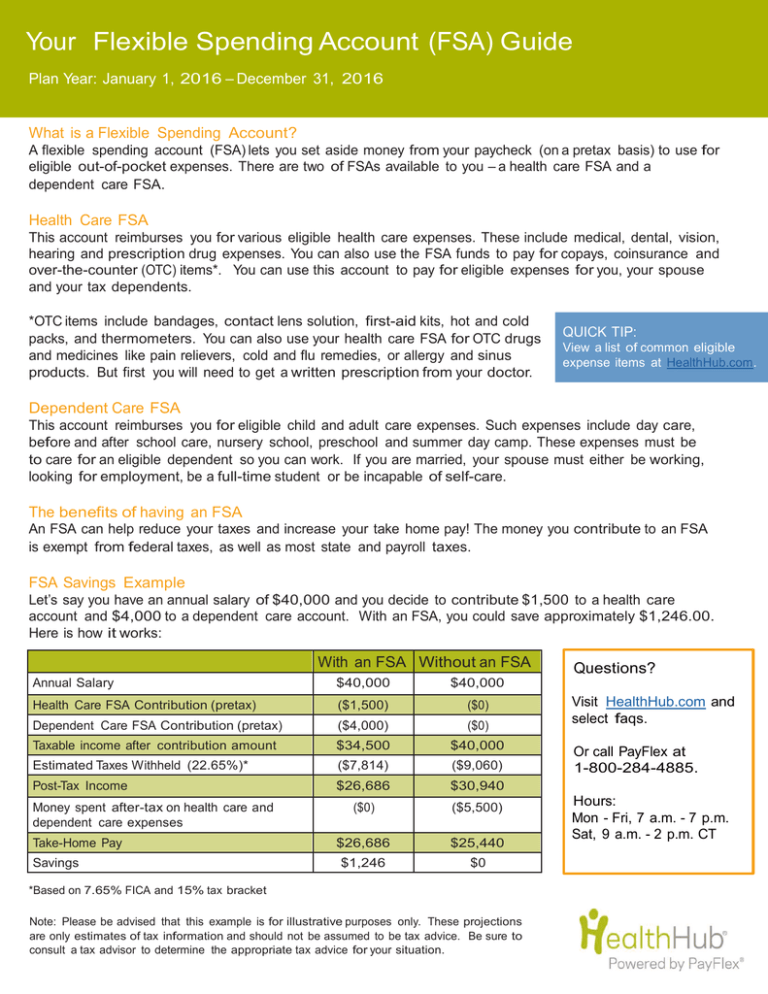

Contributing to an FSA reduces taxable wages since the account is funded with pretax.

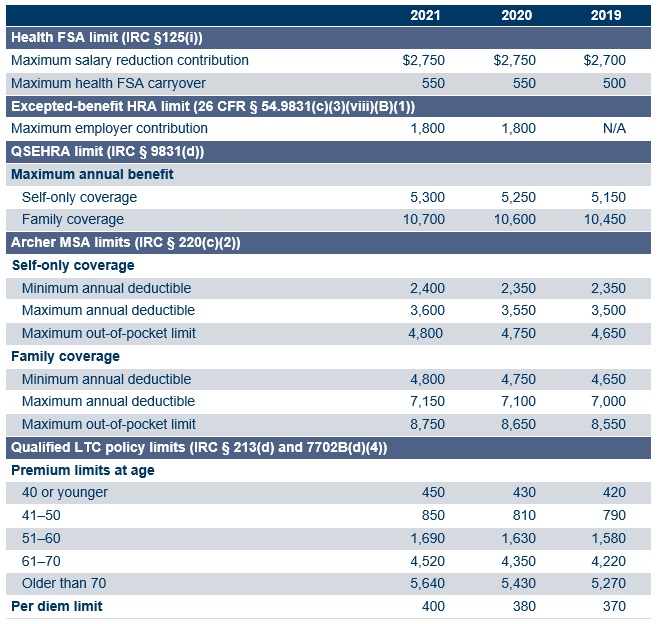

. The 2021 Healthcare Flexible Spending Account contribution limit is 2750. Ad Health Savings Accounts Simplified. Your employer FSA or financial institution HSA decides their minimum contributions for example 100.

But heres the dealin order to. For plan year 2022 the maximum contribution amount that employees can make to their DCFSAs returns to 5000. 5000 up to 10000 for couples The minimum annual contribution is 100 for either account type.

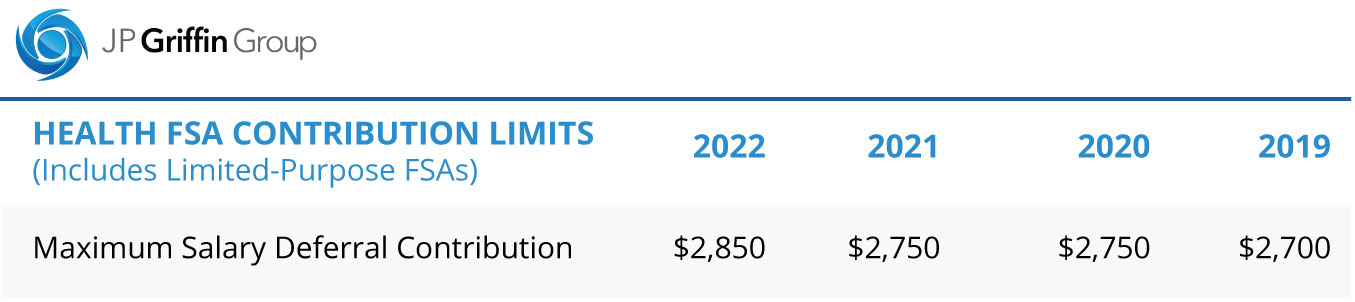

For 2022 the health care FSA and limited purpose FSA contribution limit is 2850. The federal government decides HSA maximum amounts. If you choose a filing status of.

Ad Professional Benefits Services. This limit is for each FSA participant. Elevate your health benefits.

The maximum annual amount you can contribute to a Child and Elderly Care FSA depends on which filing status you choose on your federal tax return. The employer also decides the provision. For 2021 you can contribute up to 2750 into your Healthcare FSA.

Easy implementation and comprehensive employee education available 247. Better services with TASC FSA. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

For example if your employer put in 300 and you decided to contribute 600 you have 900 to. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA.

While there is an annual limit for employee Health FSA contributions 2850 in 2022 an employer may limit its employees to less than 2850. You can roll over up to 550 into your 2021 health-care FSA a 50 increase over the previous 500 limit. Annual contribution limits.

Ad Custom benefits solutions for your business needs. Benefits Card Mobile App MyCash Texting. Ad Professional Benefits Services.

When you have a health or limited-purpose FSA the total amount is available on the first day. This means if you and your spouse are eligible to participate in a. Contributions made to an FSA are not subject to taxes.

For 2021 only the dependent care FSA. While the IRS 2021 pretax maximum for employee health FSA contributions is 2750 an employer may limit its employees to less than 2750. Keep in mind you may carry over up to 57000 remaining in your account.

FSA funds can be used to cover. For example if you earn 45000 per year and allocate 2500 to your FSA for health care expenses your estimated tax savings from your FSA is 812. The maximum you can contribute for the 2020 calendar year is still 2750.

Dependent Care FSA. An FSA helps employees cover health-related costs not included in their insurance plans. As a result the IRS just recently announced the revised.

If youre married and both you and your spouse have an FSA you can. Save Money for Your Health and Retirement. Get a free demo.

Ad Increase Your Take-Home Pay And Decrease Your Medical Expenses With FSA Benefits. In general an FSA carryover only applies to health care. You can contribute up to a maximum of 285000 See contribution information to your Health Care FSA each year.

Your Flexible Spending Account Fsa Guide

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

What S The Difference Between An Fsa And An Hsa Aspen Wealth Management

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Breaking Down Flexible Spending Accounts And Health Savings Accounts Notre Dame Fcu

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

What Is An Fsa Definition Eligible Expenses More

Hra Vs Fsa See The Benefits Of Each Wex Inc

Health Savings Account Thrive Credit Union

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Hsa Vs Fsa What S The Difference All About Vision

Flex Spending Accounts Hshs Benefits

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Tax Free Spending And Savings Accounts Baylor Scott White Health

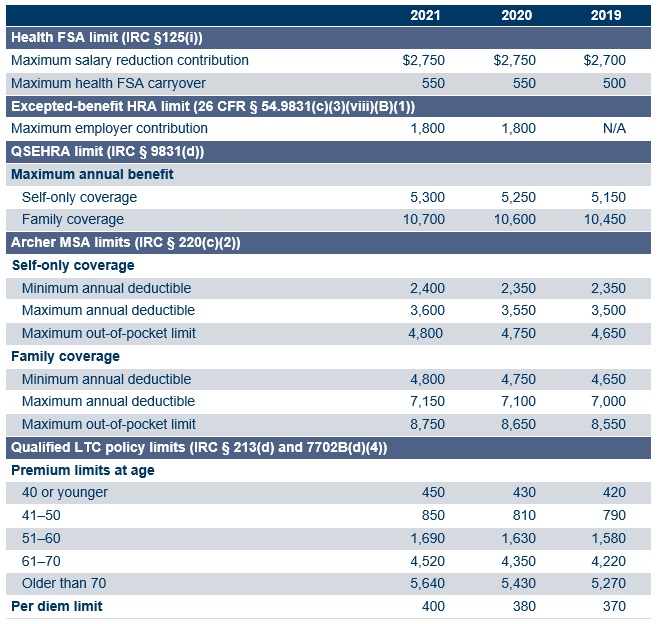

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer